Recent Blog Posts

MacDonald, Lee & Senechalle, Ltd. Recognized by Schaumburg School District 54 During Partnership Appreciation Month

MacDonald, Lee & Senechalle, Ltd. is a proud supporter of Schaumburg School District 54. School District 54 is the largest elementary school district in Illinois, serving over 16,000 students in 28 schools throughout Schaumburg, Hoffman Estates, Elk Grove Village, Hanover Park, Roselle, Streamwood and Rolling Meadows. As a law firm serving individuals, families, businesses… Read More »

Things to Consider When Buying a Business

Acquiring another company is an exciting step as you grow your enterprise. It can mean growing your customer base, a synergy of products and services, or even expanding into a new market. Before you close on your business acquisition, however, it’s important to conduct yourself appropriately. Take the time you need to make the… Read More »

What to Do if You’re in Dispute With Your Partner in Business

When you establish a partnership, you do so because you believe you and your partners see eye-to-eye. You have complementary areas of expertise, individual contributions to add to the enterprise, and a shared vision for the future. Your business partner is, nevertheless, another human being. Humans disagree, even with the best of intentions. What… Read More »

Message From the Courts: Illinois Supreme Court Reinforces Service of Process Allowable via Social Media, Text and Email

For several years now, people across all aspects of society have been relying more and more on electronic methods to communicate with one another, both personally and professionally. Attorneys and the courts are not exempt from this advancement, and many judicial systems have taken steps to keep up with the times. Illinois courts have… Read More »

Illinois Rules for Estate Planning

Estate planning isn’t merely about preparing for the end. It’s a critical process that provides you with peace of mind knowing your hard-earned assets and your loved ones will be taken care of according to your wishes, while also ensuring you are adequately cared for and protected financially during your lifetime. Below you’ll find… Read More »

Asset Buying vs. Stock Sale: What’s the Difference? What Should I Do?

When you acquire a company, the process is significantly more involved than purchasing real estate or other property. There are more options, more nuances, more regulatory issues to consider, more taxation concerns to keep an eye on, and more opportunities for unexpected liability. One of the most important decisions the parties must make is… Read More »

Differences Between LLCs and Corporations

Whether you already have a business in place or are looking to set up a new business, it’s important to understand the difference between an LLC and a corporation. Knowing which structure best fits your business needs will allow you to make the best choice in setting up your company. Let’s go over the… Read More »

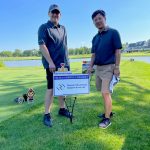

MacDonald, Lee & Senechalle, Ltd. Proudly Sponsors Little Heroes League’s 2023 Big Hero Charity Golf Outing

At MacDonald, Lee & Senechalle, Ltd. , we believe in giving back to the community that has supported us throughout the years. We are thrilled to announce our sponsorship of the Little Heroes League’s 2023 Big Hero Charity Golf Outing. This event was more than just a day on the golf course; it was… Read More »

Why Your Company Needs a Buy-Sell Agreement

Starting a business is a lot like getting married. You enter into the arrangement optimistic, hoping and planning for the best. Like a marriage, although you should hope for the best, it’s prudent to plan for alternative outcomes. With a business, it’s even more important–even if your company performs well, there will come a… Read More »

What to Do if Your Business is Sued in IL

You answer a knock at the door and a deputy sheriff or process server hands you a copy of a summons and complaint. Your business is being sued. Now what? What do you do? How do you protect your business? Read on for tips on what to do after being sued in Illinois. If… Read More »